Personal insurance is a means of controlling risk should an unexpected event occur in relation to an individual's welfare and livelihood. In this case study we will explore how Tom and Tilly applied for Life, Total Permanent Disablement, Income Protection and Critical Illness cover as a means of protecting their family, welfare and livelihood.

Financial Snapshot

Tom is working as an Engineer all the while Tilly is working as a Digital Marketing Manager. They have two children Fred (4) & Finn (2). Both are employed on a full-time basis and their situation is summarized below:

| Income / Expenses | Assets | Super Contributions / Balance |

| Tom Salary: $120,000 | Offset Account: $50,000 | FY 2024/25: SG = $13,800 |

| Tilly Salary: $100,000 | Liabilities | FY 2024/25: SG = $11,500 |

| Tom: Income Tax = $29,188 / Tilly: Income Tax = $24,195 | Mortgage: $800,000 | Tom Super: $100,000 |

| Mortgage Repayments: $50,000/a | Tilly Super: $100,000 |

Understanding Tom and Tilly’s Personal & Financial Needs

At the heart of the matter was ensuring that both and Tilly remained protected in the event of a worst-case scenario. The conversation centered around protecting their welfare and livelihood, particularly if either party were not able to work due to sickness, incurred any unforeseen expenses associated with a medical emergency or particularly how the family’s happiness would be severely compromised in the event of a premature passing or not being able to work again. They had also recently bought a home and have a mortgage. As neither Tom or Tilly could rely on support from their family, both had made the responsible decision to take out a wealth protection plan with their financial advisor.

Personal Insurances Available

- Life Insurance: A policy insuring a policy holder in the event of death or within 24 months of a terminal illness diagnosis

- Total Permanent Disablement Insurance (TPD): Insuring a policy holder if they were unable to return to work on the basis of their education, training or experience

- Income Protection: Insures an individual’s income on the basis of personal exertion in the event they were unable to work due to sickness or a disability

- Critical Illness: Offers a lump-sum payment if you’re diagnosed with a serious illness such as cancer, heart attack, or stroke

Financial Objectives

- To extinguish the mortgage on the primary residence in the event of a premature passing and provide for $25,000 for each child’s high school education expenses

- To extinguish the mortgage on the primary residence in the event of permanent incapacity and to provide a lump sum of $150,000 of coverage should there be any home modifications in the event that neither party could return to work.

- To protect 70% of their income with a 90 day waiting period to age 65

- To provide $50,000 of medical expenses for surgery or rehabilitation and to accomodate for two years of mortgage repayments in the event of severe sickness or medical emergency.

The Insurance Process

Upon reviewing their financial needs both Tom and Tilly went through the following steps with their advisor and implemented the strategy recommendations in the form of a Statement of Advice:

Insurance Needs Analysis

After reviewing Tom and Tilly’s financial position and insurance objectives, they came to the conclusion that they would require the amount of cover listed in the table below:

| Requirements | Life | TPD | Critical Illness | Income Protection |

| Liabilities to clear | $800,000 | $800,000 | Tom: $126,000 / 90 Day Wait / To Age 65 | |

| 2 Years Mortgage Repayments (per person) | $0 | $0 | $50,000 | Tilly: $56,000 / 90 Day Wait / To Age 65 |

| Children’s Education | $295,631 | $295,631 | ||

| Home Modifications | $0 | $150,000 | ||

| Medical Costs | $50,000 | |||

| Capital Require | $1,095,631 | $1,245,631 | $100,000 | |

| Less Super Balance | ($100,000) | ($100,000) | $0 | |

| Total Cover Required | $995,631 | $1,145,631 | $100,000 |

Mitigating Complexities and Pre-Existing Health Concerns: Conducting A Pre-Assessment

When liaising their insurance needs with a financial, it was noted that Tom had some pre-existing conditions that would affect his ability to ascertain insurance. His health concerns were due to the fact that he had a family history of a heart condition and high blood pressure. The financial advisor was able to complete a ‘Pre-Assessment’ where he contacted a range of insurance companies in the market and was able to asses how each company would deem his pre-existing condition and still be able to purchase a policy.

Understanding The Right Tax Structures

The advice included structuring the Life and TPD insurances inside superannuation as the policies would receive a 15% tax deduction. The premiums were also funded by extra contributions to a superannuation account (Personal Deductible Contribution) which would lower both Tom and Tilly’s taxable income. The Income Protection and Critical Illness policies were held in their personal names; both were eligible to claim a tax deduction on the income protection insurance.

Outcomes: Application and Underwriting

There are several factors to consider with such a strategy, including:

- Tom’s insurance application had to take into account a further medical assessment and blood testing because of his pre-existing conditions

- The underwriter deemed a small loading on his Life and Critical Illness insurance

- The income protection policies were tax deductible as they were held in their personal name

- An important factor that they wished to consider is to pay for their children’s education if either party was to pass away prematurely. This was important to both Tom and Tilly as they wished to send their kids to a private school

Further Considerations

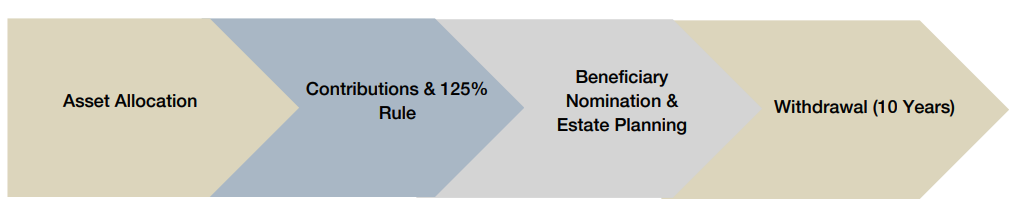

As part of the advice provide to Tom and Tilly they also considered the other areas of financial advice which were:

Learning More

Want to talk about your personal situation with one of our advisors?