An insurance (friendly) society investment bond is a financial product offered by friendly societies or insurance companies. It functions as a tax-effective, long-term investment vehicle that combines elements of investment and insurance. It is technically an investment bond but the primary purpose is for investment where the earnings are taxed at a rate of 30%. Throughout this case study we will talk to how Gerrard wishes to help his daughter Tilly (14) fund a home deposit in 10 years time.

Financial Snapshot

Gerrard (50) is a Senior Partner of a Mining Consultancy. Given his earnings capacity he is somewhat torn between purchasing another investment property and looking for a way to best utilise his surplus cashflow.

| Income | Expenses | Assets |

| Gerrard: $350,000 | Income Tax: $191,738 | Cash Savings: $150,000 |

| Investment Property Rental Income: $50,000 | General Living Expenses: $120,000 | Share Portfolio: $2,000,000 |

| Dividends: $80,000 | Investment Property: $900,000 | |

| Surplus Cashflow: $168,000 | SMSF: $1,000,000 |

Understanding Gerrard’s Needs

The need for an insurance bond pertained to a small aspect of Gerrard’s overall investment needs. The premise of establishing this bond was a consideration to help his teenage daughter eventually get started in the property market and help contribute towards funding a home deposit. As it is an insurance policy, there were also Estate Planning considerations taken into account, particularly where the bond could be vested for a given period of time without the use of a Will and mitigating any unintended tax consequences.

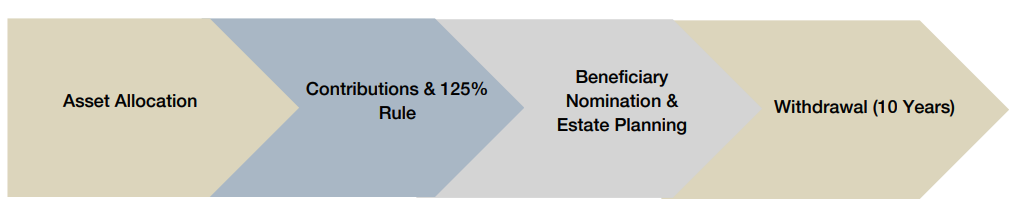

Strategy Consideration: The Details Behind Investment Bonds

- Earnings are taxed at a rate of 30% and can be invested according to an agreed asset allocation

- You cannot exceed 125% of the previous year’s contribution, otherwise the start date of the bond will ‘re-set’, i.e.

- Year 1 contributions = $10,000 while Year 2 contributions = $12,500

- Beneficiaries can be aged from the time they are born to 16; there is a vesting age between 10 to 25

- There are penalties for early withdrawals and the earnings will be subject to your personal tax return

- After a 10-year period the investor is able to withdraw the funds tax free and not be subject to any Capital Gains Tax

The 125% Rule Explained

The time line below displays how a bond holder can make contributions equal to 125% of the previous years contribution.

Financial Objectives

- To help Tilly fund a home deposit of $200,000 in 10 years time

- In the event of Gerrard’s passing, for the bond to continue to be invested until Tilly turned 25 and was in a position to receive a tax-free lump sum which could contribute to purchasing a home

Considerations with Investment Bonds

Upon reviewing their financial needs Gerrard through the following steps with their advisor and implemented the strategy recommendations in the form of a Statement of Advice. The reason why an investment bond was selected as it was an ancillary product to establishing other entities such as a Company and/or Family Trust.

Outcomes

- Assuming that Gerrard started with an initial contribution of $10,000 and followed the 125% rule; at an after tax return of 6% he would be able to make a withdrawal of the bond for $512,803

- This sum would have been received tax free and not be reportable on his tax return

- The funds available would more than adequately provide for Tilly’s home deposit objective

- Should Gerrard pass away – these funds could be passed on to Tilly and circumvent his Will / Testamentary trust and would be paid tax free to her

- At some point after the bond has matured, Gerrard may wish to consider making Non-Concession Contributions into his SMSF without the risk of selling down assets or triggering a capital gains event

Further Considerations

As part of the advice provide to Gerrard, he also considered the other areas of financial advice which were:

- Children’s Education Bonds

- Gearing e-book

Learning More

Want to talk about your personal situation with one of our advisors?