A ‘re-contribution’ strategy is whereby funds are commuted (withdrawn) from a superannuation account into a personal name and re-transferred back into superannuation as a non-concessional contribution. The purpose of doing so is to increase the exposure to the tax-free’ component of a superannuation balance so that it can mitigate any adverse tax consequences for estate planning purposes. This strategy is pertinent where adult children who are classed as ‘non-tax dependent’ as there are tax consequences for superannuation proceeds with a taxable component.

Financial Snapshot

Mary (67) is retired and her husband has recently passed away, she is survived by her only son Gerrard 43 who is single and has no children of his own. 2 years ago, she set up a retirement plan with her financial advisor and made various non-concessional contributions to the account and had previously quarantined the taxable and tax-free components by contributing to two separate superannuation accounts.

| Age | Super A | Minimum Withdrawal | Super B | Minimum Withdrawal |

| 67 | $720,000 | $36,000 | $480,000 | $24,000 |

| Component | 100% Taxable 0% Tax Free | 0% Taxable 100% Tax Free |

Understanding Mary’s Financial Needs

Mary wanted primarily wanted to know if she had sufficient income to fund her retirement and whether her assets will ‘go the distance’. She also want to know how to minimize the amount of tax she could pay as part of her overall retirement and estate planning objectives.

Financial Objectives

- To fund her retirement from 66 on an income of $60,000 per annum until her life expectancy + 5 years

- To reduce the tax liability on her superannuation balance in the event of a passing so that her son Gerrard receives a greater inheritance

Strategy Consideration: Contributing To Superannuation, Limits and Estate Planning Considerations

- The Non-Concessional Contribution Cap is the annual limit of ‘after-tax’ contributions to superannuation. An individual is eligible to contribute $120,000 as of the 24/25 Financial Year

- As part of the rules governing Non-Concessional Contributions, an individual is eligible to utilize the bring-forward rule which states that you can contribute 3 years of contributions ‘in one go’ which is for the sum of $360,000

- As part of the contributions to your superannuation, there are also estate planning/tax consequences to ‘non-tax dependents’ (i.e. adult children) should they eventually inherit the account balance

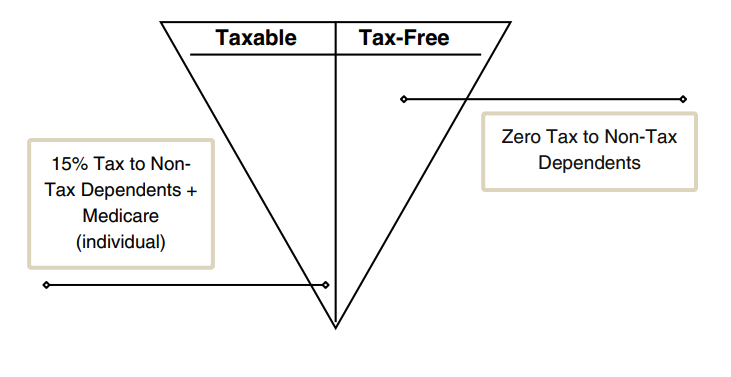

- From the ‘pre-tax’ or concessional contributions – this forms part of the ‘taxable component’ of the accounts balance, and, in the event of an adult child inheriting the account, a 15% tax plus Medicare levy is paid

- There is zero tax treatment applied to the tax-free component

Illustration: Tax Treatment Upon Passing on Superannuation Components

Quarantining The Contributions and Strategy Outcomes

There are several factors to consider with such a strategy, including:

- Making a $120,000 Non-Concessional Contribution for the FY24/25 followed by utilizing the Bring-Forward Contribution of $360,000 for FY 25/26.

- The non-concessional contributions were contributed in a separate (2nd) superannuation account so that the taxable and tax-free components were quarantined. This was to ensure that if there were any thoughts of gifting or lump sum expenses (i.e. home renovations, new car or early inheritance/gift), this could be withdrawn from the superannuation

account to reduce the amount of tax payable in the event of a passing and transfer to a non-tax dependent. - An individual is eligible to make non-concessional contributions on the provision that you are 75 years old or younger. If you are under 75 years old at any time during the financial year, you can make non-concessional contributions without needing to meet the work test.

- Your ability to make non-concessional contributions is also influenced by your total super balance (TSB) as of 30 June of the previous financial year. If your TSB is less than $1.66 million, you can contribute up to three times the annual non-concessional contributions cap over three years ($360,000).

| Year | Super A | Commutation | Super B | Contribution |

| 24/25 | $720,000 | ($120,000) | $480,000 | $120,000 |

| 25/26 | $600,000 | ($360,000) | $600,000 | $360,000 |

| 26/27 | $240,000 | – | $960,000 | – |

| 27/28 | $240,000 | – | $960,000 | – |

| 28/29 | $240,000 | – | $960,000 | – |

| 29/30 | $240,000 | ($240,000) | $960,000 | $240,000 |

| 30/31 | – | – | $1,200,000 | – |

Further Considerations

As part of the advice provide to Mary he also considered the other areas of financial advice, such as Downsizer Contributions.

Learning More

Want to talk about your personal situation with one of our advisors?